What recent shorts against the dollar could mean for gold

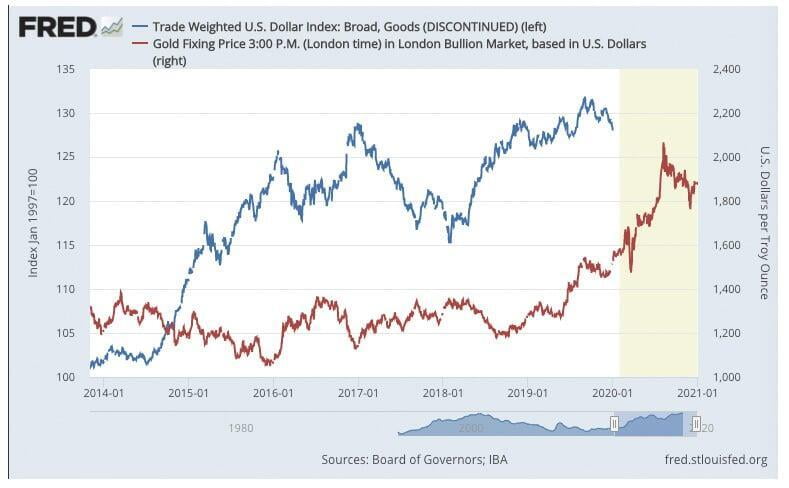

Gold is viewed as another currency, and a bet against the dollar and other fiat currencies. When the value of the dollar increases (decreases) relative to other currencies around the world, the price of gold tends to fall (rise) in the U.S. dollar. Therefore, if you are considering acquiring gold in the near future you may find it interesting that institutional investors and asset managers are increasingly shorting the dollar.

According an article published by Business Insider, “Bets against the dollar have risen to near their highest level in a decade…” and “Hedge funds, asset managers and other institutional investors increased their net short position to $34.04 billion in the week ending January 12, according to Reuters data. That was the biggest bet against the dollar since 2011.”

Now may be a good time to consider diversifying with gold.

Robertson, R. (2021 January 19) “Investor bets against the dollar are at their biggest in almost 10 years, but rising Treasury yields are a red flag for bears, analysts say”.

Retrieved from: https://markets.businessinsider.com/news/stocks/shorts-against-the-dollar-biggest-10-years-treasury-yields-2021-1-1029981009gold

Graph Credit: Board of Governors of the Federal Reserve System (US), Trade Weighted U.S. Dollar Index: Broad, Goods (DISCONTINUED) [DTWEXB], retrieved from FRED, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/series/DTWEXB, January 19, 2021.